Turning Four Hours into Profits: Your H4 Forex Trading Journey

H4 Forex Trading: The Path to Financial Independence

Once upon a time, in the world of forex trading, I stumbled upon a strategy that seemed like the golden ticket to making money in the markets. This strategy promised to let me benefit from both the excitement of intraday price swings and the bigger picture of larger timeframes. It was the H4 forex strategy, and it beckoned me with the promise of financial abundance.

My story is one of determination and discovery. I was just an ordinary trader, seeking a way to conquer the unpredictable forex landscape. To achieve this, I needed a clear plan - a strategy that would require patience, precision, and a bit of finesse.

As we journey together through this tale, I'll share the details of the best H4 forex strategy I uncovered. This plan, born from countless hours of research and practice, was tailored to leverage the 4-hour chart to its fullest potential. We'll also explore the practical trading tactics that became my trusty companions in navigating the ever-changing forex markets.

Join me on this relatable journey as we uncover the secrets of the H4 forex trading strategy. It's a story of ups, downs, and the pursuit of financial freedom – a journey that anyone can embark on to find success in the world of forex trading.

Trading for the 9-to-5 Worker and Avid Traveler

In the fast-paced world of forex trading, the timeframe you choose can make all the difference in how you approach your trades. It affects how you calculate your support and resistance levels, assess your risk, and gauge the direction of trends. For those of us balancing a 9-to-5 job or a busy family life while still craving the excitement of forex profits, the 4-hour time frame is the star of our show. Here's why:

"It allows you to actively trade the markets around the clock" - No need to be glued to your screen every second; you can make informed decisions without disrupting your daily routine.

"It combines the benefit of the intraday charts along with the big-picture trends" - You get the best of both worlds, capturing short-term opportunities while keeping an eye on the bigger picture.

In fact, the 4-hour chart is like your trusty companion for simple swing trading, perfectly suited for those of us with busy lives. So, if you're a 9-to-5 worker or a traveler always on the move but still want a piece of the forex market pie, we've got a strategy just for you – the H4 trading strategy.

What is the H4 Forex Trading Strategy?

In the world of forex trading and technical analysis, the "H4" designation simply stands for the 4-hour time frame. This means that each candlestick on the chart represents exactly 4 hours of trading activity, from the opening to the closing price. What's particularly convenient is that most major trading platforms default to the 4-hour chart, making it easily accessible to traders.

Now, it's important to note that unlike the stock market, which operates during a limited 8-hour window, the forex market never sleeps. This around-the-clock nature of forex trading is what makes the 4-hour time frame especially valuable.

In the stock market, a single 4-hour chart isn't particularly useful because it takes two of them to cover a full trading day. However, in the forex market, a single day's trading activity is captured by a sequence of six 4-hour candles. Even more intriguing, each 4-hour candle corresponds to half of one of the major trading sessions.

In the forex market, the Sydney, Tokyo, London, and New York trading sessions each have their own distinctive price action. This means that forex traders can focus on unique trading opportunities during these different market sessions.

Now, let's move on to explore the key advantages of utilizing the 4-hour trading system.

Why the 4-Hour Time Frame is Important in the H4 Forex Trading Strategy

Trading on the 4-hour time frame isn't just for traders with tight schedules or beginners; it offers unique advantages that set it apart from other time frames. These benefits include:

1. Enhanced Freedom: You're no longer tied to the market's constant demands, providing you with more flexibility in your daily life.

2. Reduced Risk Event Impact: Risk events have a less immediate impact on the 4-hour chart, giving you a clearer perspective and potentially reducing knee-jerk reactions.

3. Less Critical Timing: Timing your trades becomes less of a high-stakes game, allowing room for a margin of error and more strategic decision-making.

4. Greater Profit Potential: The 4-hour time frame can unlock larger profit opportunities, offering a sweet spot for capturing both short-term and long-term price movements.

5. Best of Both Worlds: You can harness the combined advantages of intraday time frames and larger time frames, offering a well-rounded approach to trading that suits a variety of strategies and lifestyles.

How to Use the 4-Hour Chart to Confirm Your Trades

To effectively trade on the 4-hour (4H) time frame, we'll employ Alexander Elder's Triple Screen System, a strategic approach that involves three key time frames. This system ensures a comprehensive view of the market and enhances your decision-making process.

1. The Weekly Time Frame (First Screen):

Start by analyzing the weekly chart. This is your broadest perspective, focusing on the longer-term trend. Your goal is to identify the predominant trend direction. If the weekly chart suggests a bullish trend, you should be looking for bullish opportunities in the shorter time frames. Conversely, if the weekly chart indicates a bearish trend, you'll align your trading bias accordingly.

2. The Daily Time Frame (Second Screen):

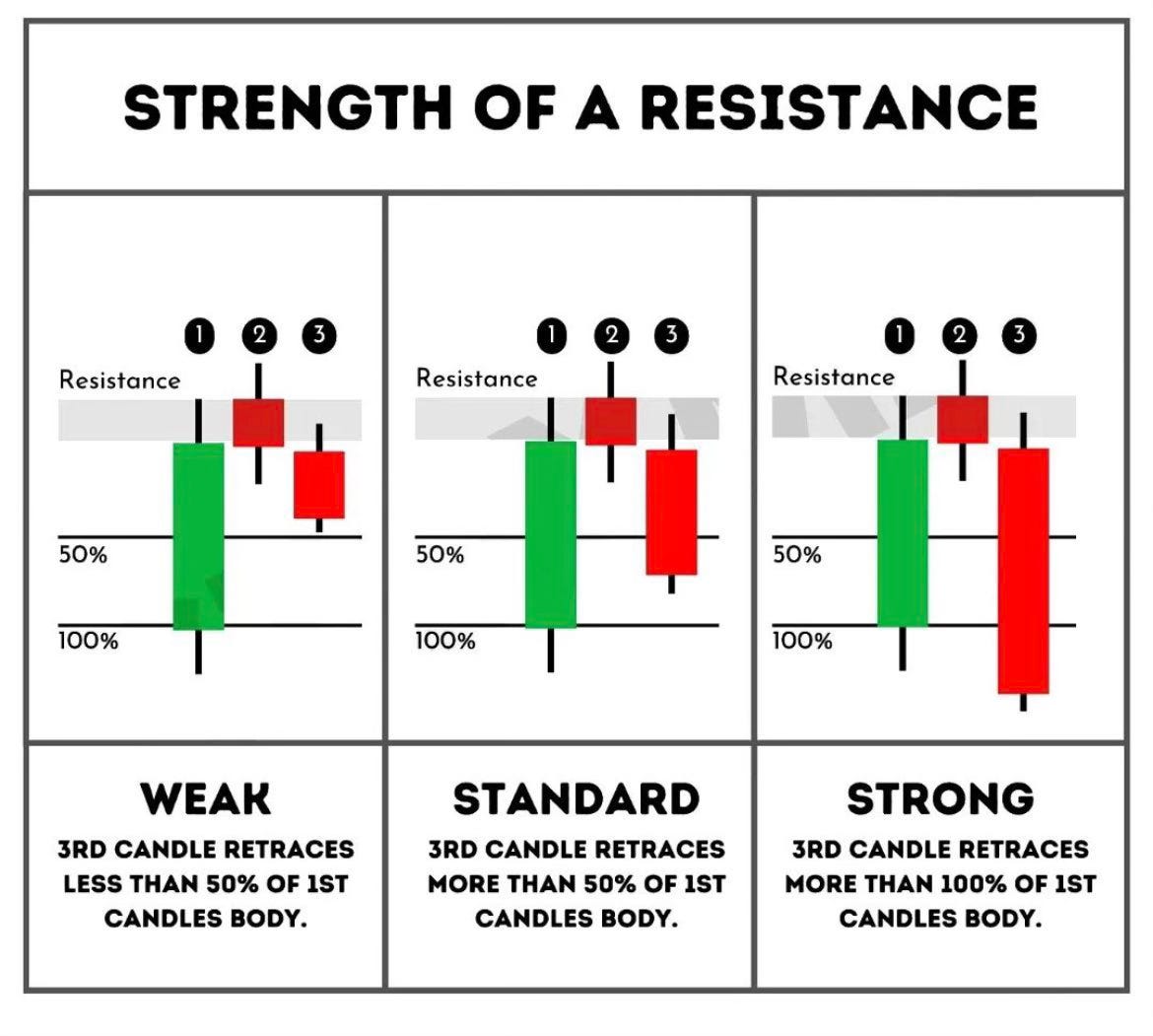

The daily chart is your second screen. On this time frame, you are looking for specific opportunities within the context of the broader trend identified in the weekly chart. If the weekly chart suggests a bullish trend, look for pullbacks to support levels as potential entry points. If the weekly chart signals a bearish trend, you'll watch for pullbacks to resistance levels. This is where you'll plan your trades and set up potential entries.

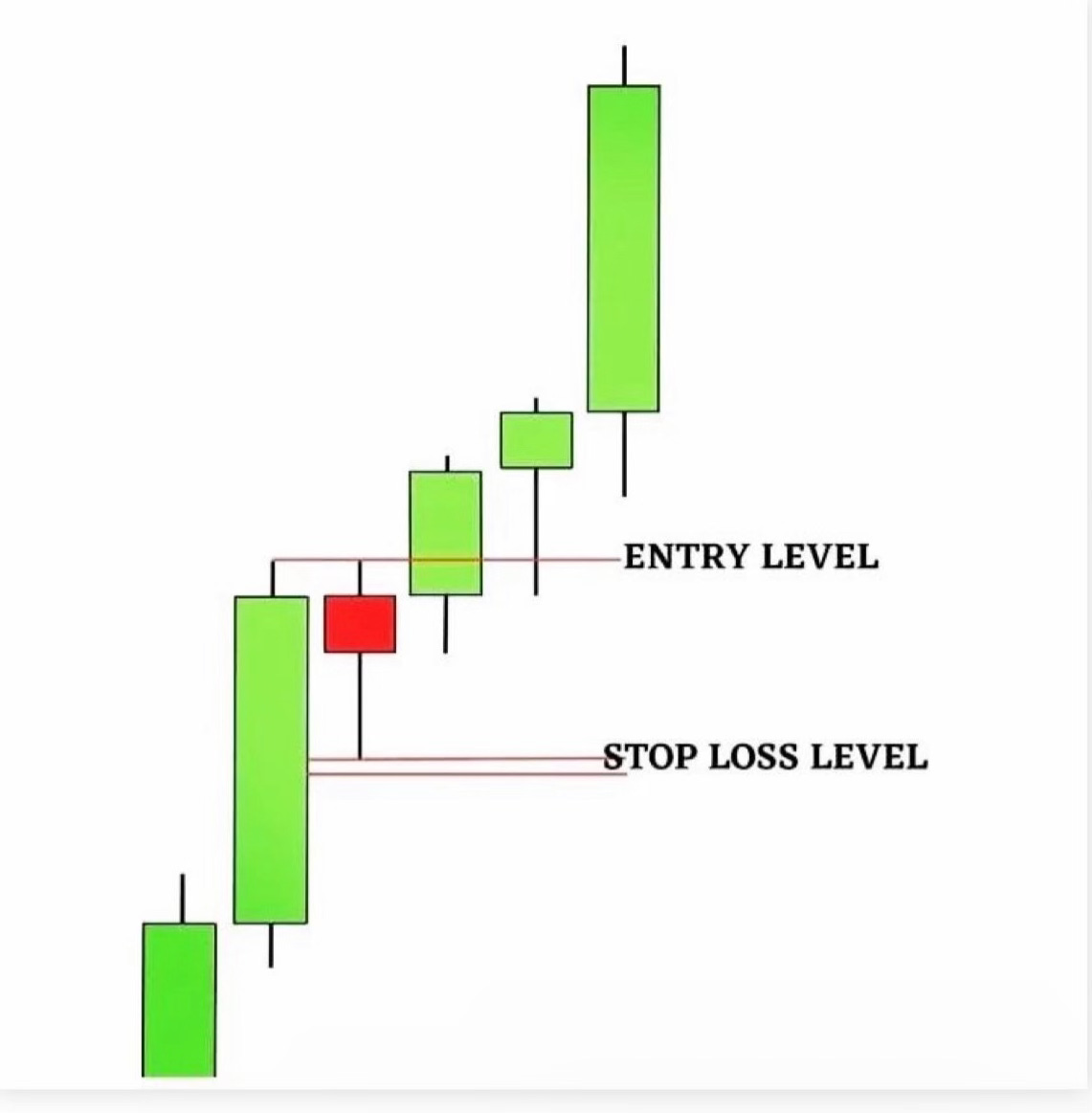

3. The 4-Hour Time Frame (Third Screen):

The 4-hour chart is your final screen and serves as your primary entry point. After identifying the broader trend on the weekly chart and assessing potential setups on the daily chart, you'll fine-tune your entry strategy on the 4H chart. If the trend is bullish, you'll be searching for higher highs and confirmation of the bullish momentum to enter your trade. In a bearish trend, you'll be on the lookout for lower lows and signs of continued bearish sentiment. The 4H chart allows you to pinpoint the most favorable moments to enter a trade while aligning with the overall trend direction.

In the Image above your see CAT 0.00%↑ in realtime at this posting …. heck your Charts 11-8-23 CAT 0.00%↑ 1400 EST.

If you're a busy person or a beginner in forex trading, don't worry, we've got a simple trick to help you spot potential trading opportunities on the 4-hour charts. It all comes down to something called "New York close charts."

Now, here's the deal: If you're using New York close charts, every 4-hour candle closes at specific times during the day. In New York time(EST), that's 5:00 PM, 9:00 PM, 1:00 AM, 5:00 AM, 9:00 AM, and 1:00 PM.

If you're on Central Time, it's 4:00 PM, 8:00 PM, 12:00 AM, 4:00 AM, 8:00 AM, and 12:00 PM. And for those of you on Pacific Time, it's 2:00 PM, 6:00 PM, 10:00 PM, 2:00 AM, 6:00 AM, and 10:00 AM.

Why is this important? Well, this level of detail might seem small, but it can actually be a game-changer in your trading success. These 4-hour candles act as your windows of opportunity.

All you need is about 10 minutes after each 4-hour candle closes. During this short time frame, you can quickly analyze your favorite currency pairs and spot potential new opportunities to make money. It's a simple, time-efficient way to keep an eye on the market without being glued to your screen all day. So, even with a busy schedule, you can still make informed trading decisions and increase your chances of success.

Swing Trading - (Can Be a Form of Trend Trading)

Aim: Monthly income

Style: Technical analysis of Weekly, Daily, 4 hour charts

Holding time: Five to thirty trading days

Time investment: One to three hours each day

Turnover rate: Five to fifteen trades per month

Commission costs: Moderately high

Expected annual return: A gain of 40 percent or

more

Here's a brief summary of the key points:

- The 4-hour (4H) time frame is a valuable option for traders, offering a balance between intraday and longer-term perspectives.

- Using Alexander Elder's Triple Screen System, you can follow the weekly, daily, and 4-hour charts to make informed trading decisions.

- Align your trades with the broader trend identified on the weekly chart, then look for entry opportunities on the 4-hour chart.

- Pay attention to New York close charts, and the timing of 4-hour candle closures, as this can greatly impact your trading success.

- You only need about 10 minutes after each 4-hour candle closes to analyze the market and spot potential trading opportunities.

Share this knowledge with at least one person, because the power of sharing and learning together is tremendous! It's a small step that can make a big difference in someone's trading journey.

You can follow for more trading insights and updates on Twitter: @immaculate_Tony or @HolisticTrader.Eth on the same page. Happy trading!