The Prop Pulse 9/15/24

Checking out potential Prop Account Trades Forex and also some of our top Creme De Le Creme Stocks via Technical Analysis

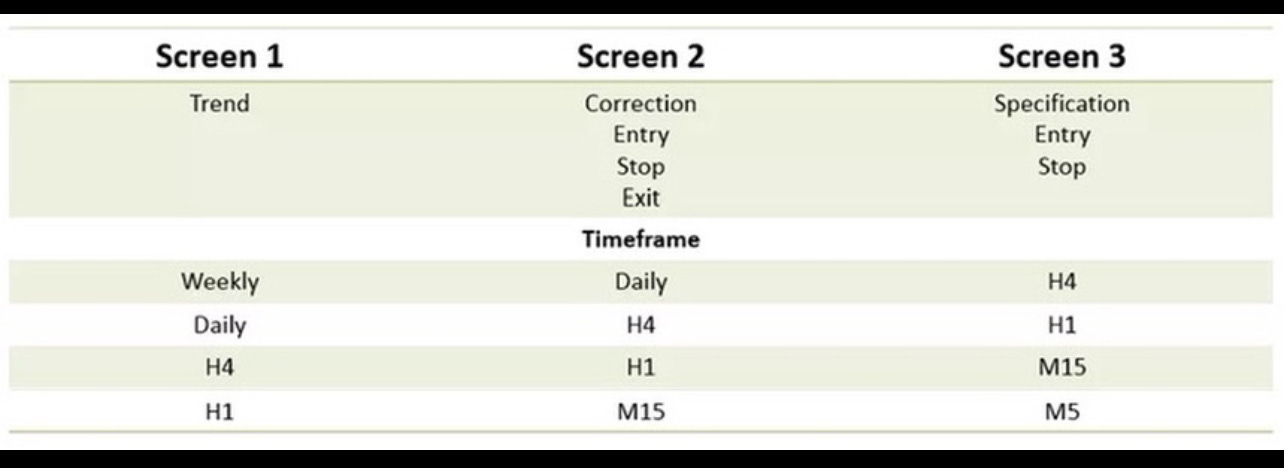

Timeframe Analysis in Trading

Markets are like puzzles with pieces that fit together in different ways depending on how long you look at them. The Factor of Five, from "Trading for a Living," helps connect these puzzle pieces.

Imagine each piece is a different time period: there are about five weeks in a month, five days in a week, and around five hours in a trading day. You can even break an hour into smaller chunks like 10-minute pieces or 2-minute snippets. The Triple Screen method, which we'll talk about more later, is like zooming out to see the whole puzzle before focusing on a section. First, pick your favorite time period to watch the market, then zoom out to a bigger picture to decide if you think the market will go up or down. Then, zoom back into your favorite view to decide exactly when to buy or sell, set your goals, and your safety nets. Adding this time perspective to your market watching gives you a leg up.

But, keep it simple. Stick to looking at two or three different time periods. More than that, and you might just confuse yourself. For example, if you're watching the market for quick trades with 30-minute and 5-minute views, looking at a weekly view would be like trying to read a book with a magnifying glass - it's just too much detail. If you're into longer-term trading with weekly and daily checks, the tiny ups and downs of a 5-minute chart are just noise. So, pick your main time view, look at the next bigger one, and start there.

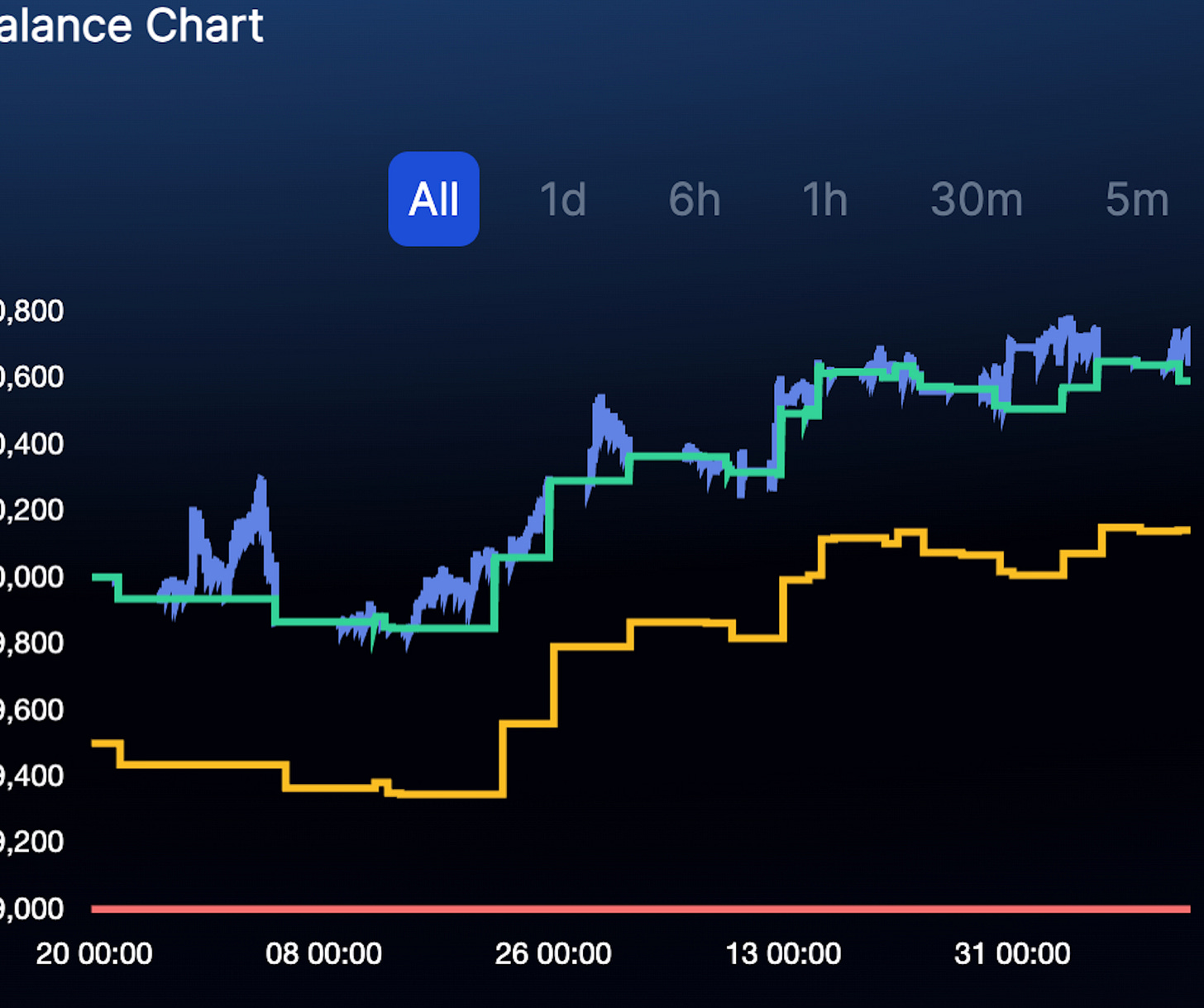

P&L Update

The Prop Trading Pulse: Calling All Prop Traders and Potential Prop Traders

The reason why trading time for money is one of the worst financial decisions is that time, unlike money, is irreplaceable. You cannot replace lost time, but you can replace the money. Once time is spent, it’s gone forever, looking back to gain more of it. Money, however, can be replenished through various means - whether it’s investing, trading, or lev…

$SPX SPY 0.00%↑

Thoughts: Currently, the market has hit a reversal midway through its fair value range and has now moved back into the retail area. Currently, I wouldn't touch this area for a bit, but if anything, consider a low-risk put/sell. However, more than anything, it will be better to sit on your hands until our stochastic indicators show us that it's either "Oversold" or "Expensive". I go over that here...

High Impact News

Keep reading with a 7-day free trial

Subscribe to Holistic Traders to keep reading this post and get 7 days of free access to the full post archives.