Starting a trading account with a forex proprietary (prop) firm can be a game-changer for beginners or anyone lacking substantial capital to trade with or just another source of income.

Here's why:

What is a Forex Prop Account?

A forex prop account allows you to trade with money provided by the prop firm, not your own. You get to prove your trading skills through an evaluation process, and if you pass, you're given access to a funded account to trade real money. Essentially, you trade the firm's capital, but you share the profits. Think 80% yours, 20% theirs.

A person might choose to use a prop trading account for these specific reasons:

Leveraging Other People's Capital: This is perhaps the most significant advantage. By trading with capital provided by the firm, traders can engage in much larger trade sizes than they could with their own funds. This can lead to higher potential profits, assuming successful trading strategies.

Initial Funding: Many prop firms start traders with an initial amount like $10k, $25k, or even $100k. This initial capital allows traders to prove their skills in a real market environment without personal financial risk.

Scaling: If a trader performs well, they’ll scale your account up if requested therefore increasing the funding. For instance, starting with $25k and then scaling up to $100k if they consistently achieve profits. This gives traders the opportunity to manage larger accounts, increasing both potential returns and the trader's credibility.

Why Prop Trade?

Imagine investing $397 to begin your prop trading evaluation. Once you achieve a 10% profit, you've not only earned yourself a $50k trading account but also get your initial $397 refunded. From there, you start trading with this funded account. The profits you make? They're yours to keep, and you've essentially done so without risking your own capital.

By following and subscribing to my Substack , I'll continue to provide guidance and support, helping you navigate the best path forward in your trading journey.

This funded trader is the real deal," says Simon Massey, CEO and Managing Director of Funded Trading Plus, in a video interview with Jongruck. Hailing from Thailand, Jongruck has made a remarkable $173,597.56 trading the US30 (Dow Jones) market in just six days. If she continues at this pace, Simon believes she could become the biggest single earner in the funded prop trading industry.

Jongruck has been trading for approximately 10 years, focusing solely on one market.

"This single-minded focus has delivered extraordinary results, and we are delighted she chose to work with FT+. I've watched her trade, and the discipline she applies is truly impressive," Simon added.

Benefits for Beginners:

1. Capital Access: You might not have $50,000 or more to start trading, but a prop firm might give you access to this amount or more. This means you can trade larger volumes without risking your own money.

2. Risk Management: Since it's not your money, your personal financial risk is limited to the cost of the evaluation process, which is often a fraction of what you'd need for your own trading capital.

3. Training and Education: Many prop firms offer educational resources, training, or even mentorship. This can accelerate your learning curve, providing you with strategies, risk management techniques, and psychological training essential for trading.

4. Discipline and Structure: Trading a prop account comes with strict rules (like maximum drawdowns, profit targets). This enforced discipline helps new traders avoid common pitfalls like overtrading or getting emotionally swayed by market movements.

5. Performance Pressure: While this can be a con for some, the pressure to perform well to retain or scale your funded account can be a pro for others, teaching them to handle stress and think critically under pressure, which is crucial in trading.

6. Profit Sharing: After passing the evaluation, any profits you make from trading are split between you and the prop firm. This means you can earn without investing a lot upfront. The split varies, but it's common to keep a significant portion (e.g., 80% to you, 20% to the firm).

7. Community and Support: Being part of a prop firm often means you're not trading in isolation. There's usually a community or forum where traders share strategies and insights, which can be invaluable for newcomers.

Drawbacks

- Rules Compliance: You must adhere to the firm's trading rules strictly. Violating these (even accidentally) can lead to losing your funded status.

- Performance Dependency: Your ability to earn depends heavily on your trading success. If you don't make consistent profits, you might not keep your funded status.

- Cost: While you're not risking your funds in the market, there's an upfront cost for the evaluation process. This might be seen as a barrier or risk for those new to trading.

- Profit Sharing: Although you get to keep a portion, you're sharing profits. If you were trading with your own capital, you'd keep 100% (minus taxes and fees).

3 Month P&L Update

A key takeaway I can share is to cut your losses early and trade small. Notice on my P&L that I never get close to the daily drawdown limit. Why? Because I "trade small" - 1% of prop capital is my maximum. Additionally, I focus on swing trading only, taking perhaps 2-3 trades a week and holding them for over a week.

When Funded Trading Plus launched they got a $100,000 funded trader in the first few days. See on this video how he passed in less than 2 hours of trading. It's quite astonishing good trading. The trader is an American who normally trades Futures markets. This evaluation test is the first time he had traded CFDs. He is now being put on a real money live $100,000 account and we look forward to him making great profits and will update on YouTube.

How do I enter a trade? …. PSAR Rules

PARABOLIC TIME/PRICE SYSTEM

ENTRY ONLY ON 4 HOUR TIMEFRAME (My Rules):

A position is entered when a price penetrates the PSAR.

Referring to the image below, from left to right:

If the price is in our wholesale area on the 4-hour timeframe, we wait for an uptrend and for the price to break past the PSAR. You'll see "Flipped to Buy".

If the price is in our retail area and it breaks down through the PSAR on the 4-hour timeframe, you'll see "Flipped to Sell".

Stop Loss/Trailing: Set your stop loss at the initial PSAR entry, then trail it with the PSAR. We'll dive deeper into these nuances in future Substack posts and video trainings, so stay tuned.

Gold Outperforms the Dollar

The DXY (U.S. Dollar Index) serves as a benchmark for assessing the overall value of the dollar in international markets. It's a method used to gauge the dollar's strength or weakness relative to a basket of key currencies, which are among the most traded and influential in the foreign exchange market.

Recent trends indicate that the dollar's performance has been on a steady decline -4% year to date. (See Image Below)

Now, consider gold. If you had stored your wealth in gold, you would have seen an increase of 35% year-to-date, as opposed to the dollar's decline. So, where would you prefer your money to be? In a declining dollar or growing gold?

Think about this: if you have savings in an account, you could store that money in gold, potentially yielding more than what a declining dollar would. Essentially, if you're saving in dollars, your money is just sitting in the bank or wherever you keep it, disintegrating—withering away, if you will.

Here's an option: store your value in what we call "Lawful money."

High Impact News

$SPX SPY 0.00%↑

52 week range:

Thoughts: Currently, the price is above our retail area, which to me suggests that it needs to cool off or a correction might be due. Our stochastics is high on the daily chart, which doesn't necessarily mean the price MUST fall, but from a risk/reward perspective, there might be a better chance for profit on a downward movement.

Now, I'm waiting for the 4-hour chart to hit the PSAR on a downtrend, and I'll trail behind it to maximize profits.

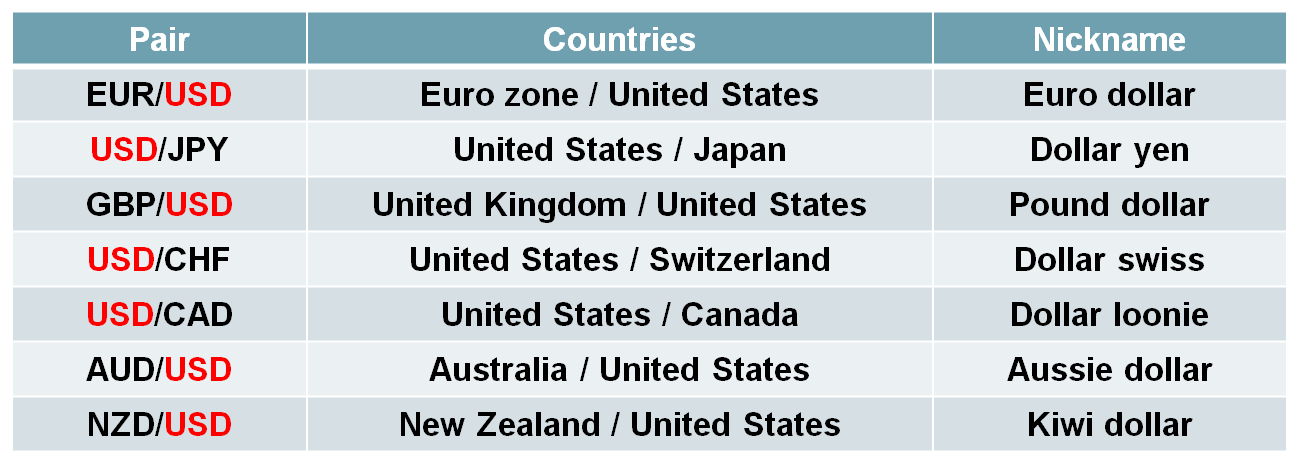

Top Forex - Wholesale or Retail

Let's review tickers that might present potential trade entries and discuss any trade management strategies from last week. Notably, we have an active buy from last week on $USDJPY

Keep reading with a 7-day free trial

Subscribe to Holistic Traders to keep reading this post and get 7 days of free access to the full post archives.