We are excited to announce that Holistic Traders has expanded its reach to 29 states and 29 countries, attracting thousands of readers each week! We sincerely thank our loyal supporters for their continued enthusiasm. We encourage you to keep reading and sharing our content, which features insights from a trader recognized as a top performer in the top 10% of the field.

Prop Trading Ideas

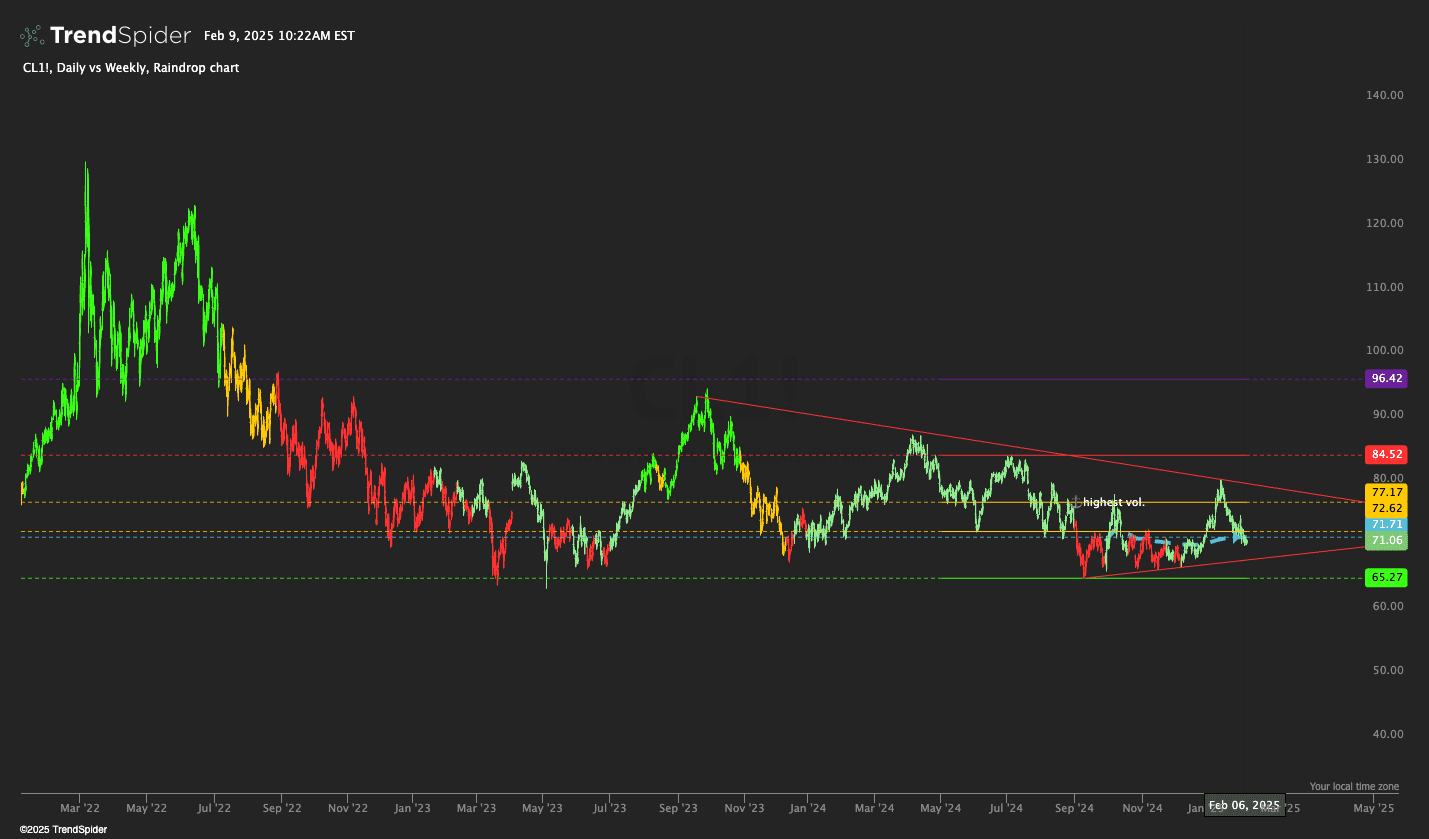

Oil Purchase Strategy:

Buying Range: We're planning to buy oil at prices between $65 and $71.

Average Price Target: The average price we expect to pay is around $71.

Safety Margin: To be cautious, we aim to keep our average purchase price below $71.

Price Goals:

$GBPUSD

GBPUSD Wholesale Purchase Strategy:

Buying Range: We're targeting to buy GBPUSD between 1.24467 and 1.27718.

High Target: Our goal for the upper price limit is 1.32978.

Golden Ratio: We're also monitoring a potential peak at 1.38238.

$EURJPY

EURJPY Wholesale Purchase Strategy:

Current Wholesale Range: We're in a buying zone with prices from 154.41900 to 162.44329.

High Target: We're aiming for a peak of 175.42500.

Golden Ratio: Keeping an eye on a potential high at 188.406.

Weekend Adventures

Stocks to hold per portfolio account size

When managing an investment account, it's important to consider your account size when selecting stocks or shares. For example, if you have an account with $10,000, investing in high-priced stocks like Microsoft, Home Depot, or NVIDIA may not significantly impact your portfolio's growth. With smaller accounts, it can be challenging to achieve meaningful gains since the required capital to see substantial movement in these stocks is limited.

For those with account balances ranging from $100,000 to $1 million, there are additional opportunities to explore that may better fit your investment goals. It's also worth considering options trading, which can offer a lower premium, allowing for more effective risk management.

If you have any questions or would like assistance with your portfolio and investment strategies, please feel free to reach out.

$10K and under Portfolios:

$100K to 1 million Portfolios:

XLE, TGT, SMH, BABA, PG, GLD, XOM, WM, IBM, SBUX, IWM, MCD, DIS, AAPL (all under $350/share)

Share this link with someone right now and encourage them to follow this Substack. I’m excited to show them how to grow a small account. While it may take time, having that initial spark is essential. Let’s take this journey together and make progress happen!

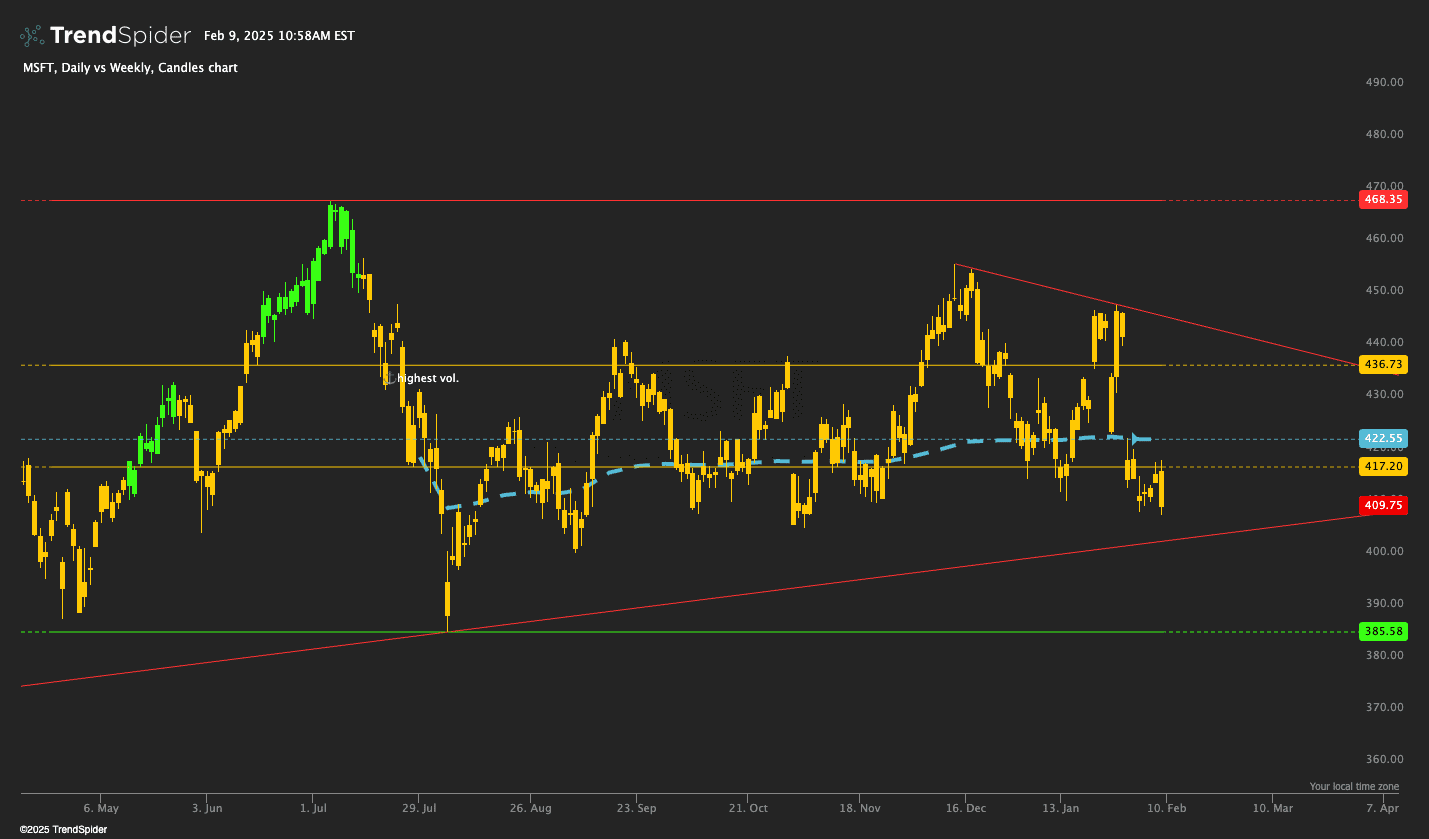

MSFT Stock Analysis:

Current Price: MSFT is currently trading at $409.

Oversold Status: The stock is considered deeply oversold, below its average value of $422.

52-Week Low: It's near its 52-week low of $408.

High Target: Aiming for a high of $428.

Golden Ratio: Watching for a potential peak at $468.

DG 0.00%↑ Market Analysis:

Observation: I know you've seen Dollar General ( DG 0.00%↑ ) consistently in both small country areas and larger cities. It's safe to say that DG's market presence may not be going anywhere. What are your thoughts? Do you invest in Dollar General stock ($DGT)? Do you know anyone who does?

Current Market Condition: The chart indicates the asset is heavily oversold, trading below its wholesale price, suggesting a significant buying opportunity.

Price Points:

Average Price: $83

Wholesale Range: Between $82 and $65

Resistance Level: At $147

Thanks for reading

- Immaculate Tony