Every morning, when the sun rises, we have another chance at a new day to be better than we were yesterday. Your only competition is yourself. Are you waking up in the morning with the sun? Maybe you are beating the sun up? In nature, animals are moving and chirping, roosters crowing with the sun; that has a meaning I won't go into, as it's my opinion. If you only pay attention, I will say this: we should be doing the same. Life isn't guaranteed, and neither is tomorrow, so we must take advantage of the day we have and be the best. Perform each task as if it were your last, leaving nothing on the line, making sure that you could sign off on everything; know that people will say YOU did this greatness. You have greatness within you, but it's up to you to ignite EVERY SINGLE DAY. Be the light at the end of the tunnel for others instead of searching for it. It is within you. From this day on, get up in the morning and chase greatness within you. Read good books, hang around only with people who uplift your spirit, eat HEALTHY foods (In my opinion, preferably ones without blood), and practice the golden rule: DO unto others as you want done to yourself. YOU are GREAT, YOU have a PURPOSE.

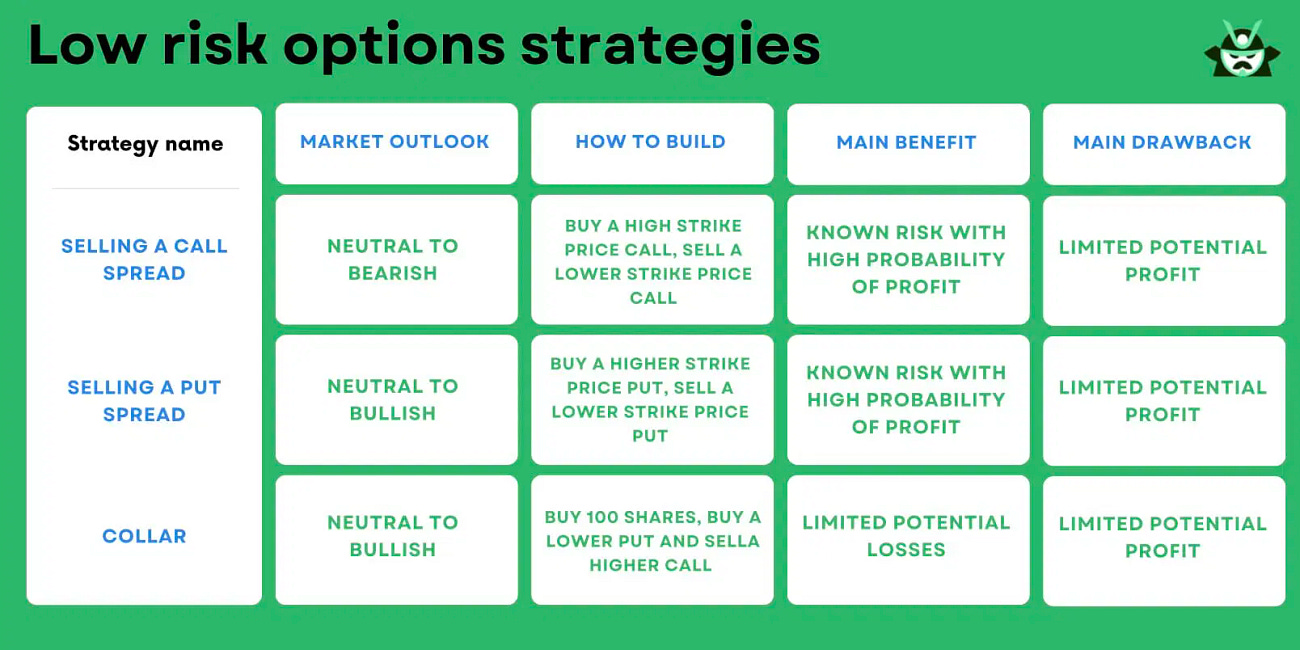

Strategy - Put Spread

What And Why

A put option is a contract

Put sellers have an obligation to buy the underlying at the strike price any time up until the expiration date of the put option

Put buyers have the right (but not an obligation) to sell the underlying at the strike price any time up until the expiration date of the put option ( Which most people are use too)

A Short Put Vertical is created by selling a more expensive put and by buying a less expensive put with the same expiration resulting in a net credit to the account

Assumption : Bullish or As I like to say “Buy Wholesale Sell Retail”

Stock Goes Up: Contracts gain value, IV could expand.

Stock Stays The Same: Theta decay works for us, but at a slower rate.

Stock Goes Down: Contracts lose value, IV could contract.

Max Gain(Profit) : Limited to the credit received; max profit occurs if options expire worthless.

Max Loss: Difference between the strikes minus (-) the credit received.

Break-Even (BE) Point: Short Put strike minus (-) the credit received.

Portfolio Allocation: Traders position size based on the theoretical max loss. Sidenote: I highly encourage your max risk to be max $500 that may allow you to take three contracts at 1.50 per contract start small.

Will want to be aware of upcoming events such as dividends or earnings announcements.

If volatility is high, some consider this a good time to sell as premiums are often higher.

So when you hear high IV (Implied Volatility) rank between 60% and 100%, think that it is most likely able to contract, compared to when it is in low IV (Implied Volatility) at 30% or lower. An analogy you could visualize is a rubber band; with high implied volatility, the rubber band is extended and can snap back, whereas with low implied volatility, the rubber band has room to stretch. (As discussed in post below)

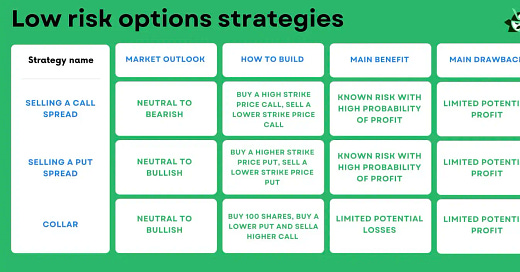

Options: Short Call Vertical Pt. 1

Bob Proctor always emphasized the importance of creating multiple sources of income (MSI) to achieve financial freedom and wealth. He taught that MSI is not about increasing exponential hours of work or focused attention, but rather about increasing exponential, 'round-the-clock income through easy steps.

Hey! Are you looking for a supportive trading community where you can connect with like-minded individuals, learn from experienced traders that have been through what you are going through, or just want to share your own insights with others and help others learn? Look no further! Our tight-knit group is here to help you navigate the exciting world of trading and achieve your financial goals. Join our FREE community focused on helping others and not just self-interest; become part of our trading family!

Potential Benefits

Selling short put verticals can potentially generate income in the portfolio.

This vertical credit spread creates a lower Break-Even than buying stock at the time the bullish strategy was created.

Gains are limited to the net credit received.

Time Frame: Short and Intermediate term

Expirations : 20 - 50 days out

Potential Risks

Max Risk: Difference between the two strike prices minus the credit received to enter the trade (and any commission/fees).

Short options can be assigned at any time before expiration regardless of the In-The-Money (ITM) amount.

One max loss can take away all your gains on several profitable short put vertical trades. Learn to take your loss or potentially roll your trades for credits only.

Risk Profile, Numbers Know your numbers

Strategy Goal, Active vs. Passive, PTV:

Income

Active

Price Action: Bullish to Neutral

Time: Positive. the thing about selling options is time is your friend you want the time to just tick tick tick away. here time is on your side.

Volatility: Negative. As the value of the volatility fall so does the value of your option trade This goes back to the High IVE (60%-100% IVR) you want it to be high when you place you trade.

Are you interested in becoming a retail prop trader? Ready to prove your skills and get funded?

When Funded Trading Plus launched they got a $100,000 funded trader in the first few days. See on this video how he passed in less than 2 hours of trading. It's quite astonishing good trading. The trader is an American who normally trades Futures markets. This evaluation test is the first time he had traded CFDs.

For those interested in one on one training because you may not have time to be in a group capacity, and want to use OPM (other people money) feel free to message me.

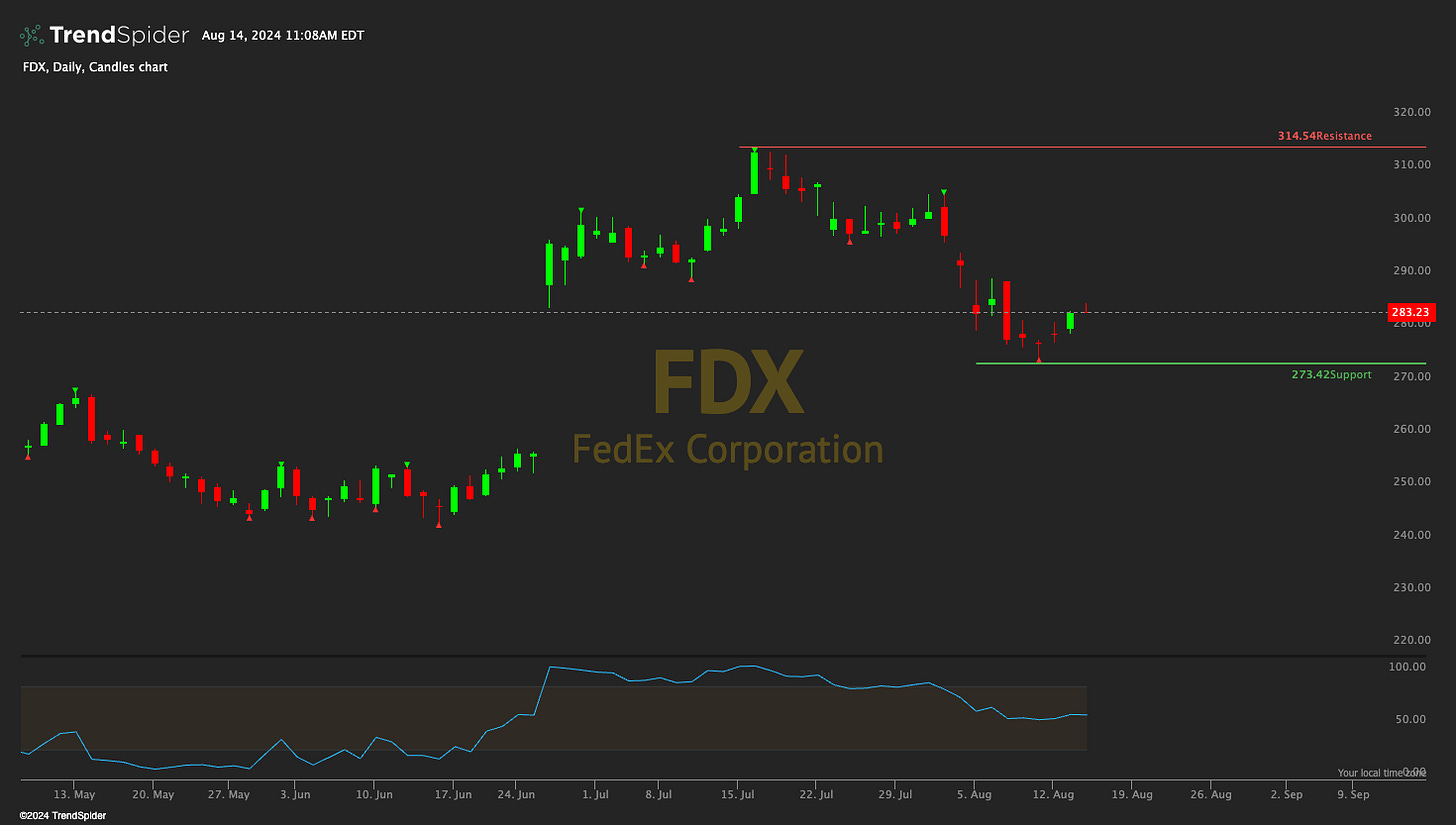

Short Put Verticals: Potential Entry Signals

Technicals to consider if selling a short put vertical

Stocks in a bullish or bullish/neutral trend

Stocks bouncing off support: Closes Above the High Of the Low Day

Underlying breaks out of resistance: Stock trades above resistance during day

Look for strikes below recent support